The beginning of any project is like planning to lay siege to a castle. The business must take advantage of proven tools to evaluate the risks against the rewards. Losing a battalion of soldiers to take a castle for only a few trinkets and beads is certainly not a sustainable model. And will likely get you killed or far worse: fired! The need to evaluate initiatives in business is just as critical as the outcomes can dramatically impact the livelihoods of your team members. The projects you will approve range from large initiatives into new lands (new products) to smaller endeavors as simple as rebuilding the castle walls (system upgrades). Obviously, the projects with larger spends, greater risk, and higher potential impacts will require greater scrutiny than smaller projects. The key in developing a strategy on how to successful traverse the analysis draw bridges is not only to know what types of evaluation gates are available, but also understand the mote dragons lurking beneath each gate.

The beginning of any project is like planning to lay siege to a castle. The business must take advantage of proven tools to evaluate the risks against the rewards. Losing a battalion of soldiers to take a castle for only a few trinkets and beads is certainly not a sustainable model. And will likely get you killed or far worse: fired! The need to evaluate initiatives in business is just as critical as the outcomes can dramatically impact the livelihoods of your team members. The projects you will approve range from large initiatives into new lands (new products) to smaller endeavors as simple as rebuilding the castle walls (system upgrades). Obviously, the projects with larger spends, greater risk, and higher potential impacts will require greater scrutiny than smaller projects. The key in developing a strategy on how to successful traverse the analysis draw bridges is not only to know what types of evaluation gates are available, but also understand the mote dragons lurking beneath each gate.

Gathering Intelligence

The first and most important step is to gather some intelligence about your team, the environment, and of course, the enemy. Intelligence about the future is seldom perfect unless you have a resident wizard. So be prepared to make some reasonable estimates. The data you assemble will form the foundation of the decision process so also expect to invest more time in preparing it than analyzing it. A good white knight or PMO will assemble the following items:

-

A reasonable estimate of the initial and on-going costs to initiate, deliver, and maintain the project deliverables. Projects often underestimate the on-going support costs because the PMO is not familiar with the business domain.

-

A reasonable projection of revenue as a result of the project deliverable. This must be in terms of the business as a whole rather than any one department or fiefdom. A wise PMO will avoid the temptation to use internal cross-department charges or recharacterize internal benefits as departmental “revenues”.

-

An assessment of the impact of taxation. This will either require the input of the CFO or a local sorcerer.

-

The discount rate to account for the time value of money. This can simply be a mutually agreed representation of the rate between the current borrowing rate and the opportunity costs of other uses. It will not be possible to be exact so close is sufficient.

-

Strategic directions of the business. This requires understanding how to connect the dots to get to the business’ long-term market position. Taking the river valley may not be cost effective in itself, but it is critical if it allows you to conquer the downstream kingdom of gold.

Secret Bag of Tricks

The next step is to understand the 3 most common tools available in your secret PMO bag of potions. These mystical tools require forming a view as to the evaluation period as well as the project deliverable life: these are not the same. The most common evaluation period is usually 3 years which is driven by the royal court’s bonus plans or corporate public reporting. We start with payback period,” says Ron Fijalkowski, CIO at Strategic Distribution Inc. in Bensalem, Pa. “For sure, if the payback period is over 36 months, it’s not going to get approved. But our rule of thumb is we’d like to see 24 months.” (1) So let’s open our bag of tricks and see what we have to work with:

Gate 1: Return on investment

Return on investment (ROI) is calculated by subtracting the project costs from the benefits and then dividing by the costs. The higher the return is on the investment the better. The accountants show it as ROI = (total discounted benefits – total discounted costs) / total discounted costs. However, this method does not address the rate at which the benefits are recovered. It assumes the recovery rate is level. Thus, a project which has a larger % of the recovery early is weighted the same as project which recovers the investment later in the evaluation period. A good online calculator can be found at http://www.money-zine.com/Calculators/Investment-Calculators/Payback-Calculator/

Gate 2: Payback Analysis

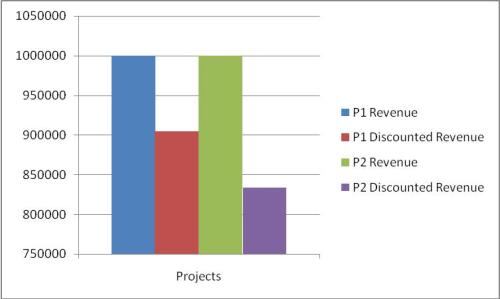

In simple terms, this is the time required for the additional booty to pay back the King for the amount they spent to initiate, build, and maintain the deliverable. A common way to show this is to plot the cumulative costs and revenue on a graph. See the example of 2 projects (P1 and P2) with the same total spend, but very different payback rates. The data points must show the cumulative amounts (in present dollars) and not the amounts for each period. The intersection of the graph lines will show the payback timeframe on the X-axis. “Payback period is the most widely used measure for evaluating potential investments.”(1) “Payback gives you an answer that tells you a bit about the beginning stage of a project, but it doesn’t tell you much about the full lifetime of the project,” says Chris Gardner, a co-founder of iValue LLC, an IT valuation consultancy in Barrington, Ill (1).” A sample cost benefit analysis template can be found at http://jaxworks.com/payback%20Analysis.xls

Gate 3: Net present value

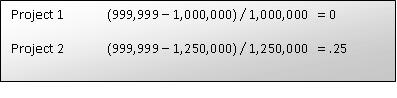

Once the King’s advisers have the data for the payback analysis, the next step is to discount it for time. “Net present value (NPV) analysis is a method of calculating the expected net monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time (4).” The evaluation simply incorporates a declining factor for each period. The higher the net present value the better. In this case, both projects (P1 and P2) have the same revenue and payback period. However, once the booty is discounted for taxes, interest, and inflation, the revenue on Project 2 looks more attractive. Thus, this tool takes into consideration the rate of the recovery by discounting rewards gained later in the deliverable life. A sample template can be found at http://www.engage-consulting.biz/docs/cbatemplate.xls

Payback Analysis Traps

Now we have accepted our noble quest and we understand the tools available, we must heed the warnings of the wise sage. It is not just critical to know what the tools show, but also what they don’t show. Many PMOs have fallen victim to the following payback analysis traps:

· The PMO attempts to do the payback analysis within an industry and customer base they really don’t understand. The best payback analysis is done by core management team familiar with the business.

· The false belief the estimated and often intangible benefits will actually materialize with any certainly. Don’t believe your own propaganda. Clever estimates can usually swing the project analysis either to the good or bad. Spend more time validating the estimates than taking comfort in the analysis results.

· The failure to consider the big picture revenue and value of strategic leverage. The analysis tools don’t consider the long-term strategic benefits for the business. The crystal ball cannot connect the dots because it ignores financial performance after the break-even point (outside of the evaluation period). Many times the life of the project deliverable is much more durable and will provide revenue or benefits much longer than 3 years. The pitfall is that many companies pass on projects that would generate millions of dollars of recurring revenue over the long run simply because the immediate payback does not meet some arbitrary PMO metric.

· The creation of fictitious fiefdoms in order to assert creative attempts to quantify internal benefits as departmental revenue. The IT group is not a profit center. The focus must remain on the business.

· The models tend to give the PMO the appearance of too much power. This can become a distraction as the PMO is not usually familiar with the domain or the business.

· Resting comfortable in the robes of your analysis if the project fails the tests. Often a second look is often necessary to avoid having spreadsheets eclipsing the bigger picture. Many of the great new ideas like storing music on thumb drives or building desktop computers in bright color might have failed these short-term tests.

As you plan your next project whether it is charging into new lands to conquer or simple patching a few crumbling walls, the team must be comfortable using the payback analysis tools in their bag of tricks. However, the royal PMO must take care to avoid the common pitfalls or they will be devoured by the mote dragons before they even get near the gates to the castle.

See how our consulting services can help you today.

Resources

(1) http://www.computerworld.com/s/article/78529/ROI_Guide_Payback_Period?taxonomyId=074

(2) http://cbdd.wsu.edu/kewlcontent/cdoutput/TR505r/page15.htm

(3) http://www.mindtools.com/pages/article/newTED_08.htm

(4) http://mydeskdrawer.com/projectmanagement/financial.html

(5) http://coen.boisestate.edu/mkhanal/present.htm

(6) http://web.ccsu.edu/business/faculty/petkovao/mis460prmgt/lectures/ch4%20fin%20analysis.htm

(7) http://downloads.techrepublic.com.com/5138-6321-729928.html

(8) http://jobfunctions.bnet.com/abstract.aspx?assetid=729928&node=6321&docid=313413&promo=100511